Your Trusted Parramatta Mortgage Brokers

Regardless of whether you plan to upgrade, refinance your mortgage, invest or buy your first Parramatta home, you want the lowest possible interest rate

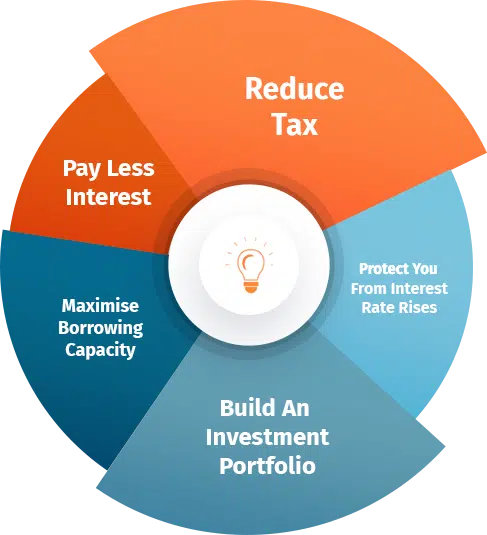

We strive to offer a complete mortgage solution that perfectly meets your needs. It’s part of our free service to you. We can suggest ways for you to:

- Save thousands in interest

- Protect yourself from future interest rate hikes

- Reduce your tax burden and keep more money in your bank

- Maximise your loan or mortgage capacity

- Develop or grow your investment property portfolio

Request a Free Lending Strategy Session from a Parramatta home loan expert to learn more, or get in touch with us to have your mortgage reviewed.

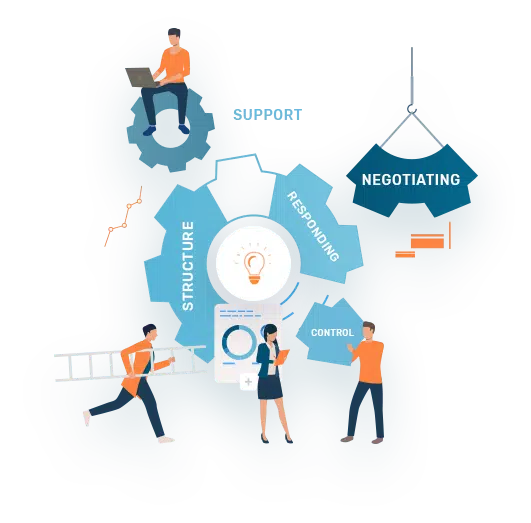

Get Support From Mortgage Broker Experts Through Your Entire Property Ownership Journey

In addition to finding you a great home loan deal now, you’ll also benefit from proactive, ongoing service to optimise your finances long after you’ve received your loan. Your Parramatta mortgage broker will

- Negotiate with lenders to ensure that you get a better deal than you could on your own

- Structure your loans for maximum flexibility and control

- Offer prompt and efficient service

- Review your portfolio to advise you of opportunities

- Provide you with relevant information and advice

Your Trusted Lenders in Parramatta NSWFREE Service

- All loan advice tailored to your lifestyle and budget

- Our Parramatta mortgage brokers are available 7 days a week

- We streamline the mortgage process so you don’t have to run around

- We work with local and international clients

- Your Parramatta mortgage brokers will keep you updated so you’re never left in the dark

- No loan is too big or too small

- You have access to 30+ home lenders, including all the major banks

- We are not owned by or aligned with any financial institution

- We will strive to get you free valuations and credit reports

- ALL prospective lenders can access a free, no-obligation Lending Strategy Session

What Our Mortgage Broker Clients Are Saying

"Marcus guided us through the process expertly, and was always on hand"

Marcus helped us secure our mortgage for our first property in Australia. He was fantastic throughout. As first time buyers he guided us through the process expertly, and was always on hand to answer any and all our questions. We frequently changed our minds in the early stages of the mortgage process, but Marcus always dealt with these changes promptly. I would highly recommend Marcus as a mortgage advisor and will be using in in the future for any mortgage applications and reviews we carry out.

"Marcus went above and beyond"

Marcus went above and beyond to find us the right mortgage provider, offering any assistance we needed. He was even able to go back and get a generous rate discount after the initial offer. You won’t find another more helpful and trustworthy mortgage broker. Highly recommended!

"Can confidently recommend!"

Marcus explained in simple language my home loan options. Very happy with the service and can confidently recommend!

"Marcus took to explain everything in the simple terms"

Marcus was a great help right from the start at our first meeting it was apparent that Marcus acted in the clients best interest & his advise was based on that and not selling a service. Your first mortgage can be quite daunting and that was all mitigated with the time he took to explain everything in the simple terms that helped me take all the information in. If I ever need another Mortgage or when I require a re-finance Marcus will be the first phone call.

Frequently Asked Questions

How are you different from other mortgage brokers?

Any mortgage broker can help you find a home loan. Only Brighter Finance helps to structure your lending throughout your whole property ownership journey so you can grow your wealth, freedom and security (while saving a fortune in interest and tax along the way).

What kind of clients do you work with?

Whether you’re looking to purchase your first home, upgrade, refinance, or invest, we can help. As part of our free service to you, we aim to provide a total solution that fits your needs perfectly – regardless of what stage in the property journey you’re at. Contact your trusted Parramatta mortgage broker today.

Where are your clients based?

Brighter Finance is headquartered out of Sydney’s inner west, servicing Parramatta NSW.

However, we help clients from across Australia and beyond (expats are a speciality of ours!).

We’ll help you schedule a convenient time to speak, regardless of what timezone you’re in.

Lending Strategy Sessions can be conducted face to face or via phone, Skype or email – whatever works for you!

How much can I borrow?

Our borrowing power calculator takes into consideration your income, expenses and situation to help you understand what you could potentially borrow.

What would my loan repayments be?

Our loan repayment calculator allows you to see exactly how much your repayments would potentially be.

How much would stamp duty be?

Put in your approximate purchase price and the state or territory of your intended purchase to get an approximate cost for stamp duty.

Help me compare loans

Our calculator will help you compare two different loans, providing you with both initial and ongoing cost savings for your loan.